What’s the best way to save?

Compare ways to save

When it comes to saving money for college, there are many options available—each with their own set of benefits. The best option for you depends on multiple factors, like your savings goals, risk tolerance and investment preferences.

Edvest 529 may check all the right boxes

529 plans are one of the most popular ways families choose to save for college. Other common methods include Roth IRAs or a standard bank savings account.*

- yes checkmark Can reduce your 2026 state taxable income up to $5,280

- Limitations apply.4

- yes checkmark Tax-deferred growth

- yes checkmark Tax-free withdrawals for qualified college expenses

- yes checkmark Investment portfolios

- yes checkmark No income restrictions

- yes checkmark No age restrictions for withdrawals

- yes checkmark High annual contribution limits

Roth IRA2

- no x No state tax deductions

- yes checkmark Tax-deferred growth

- potential question mark Potential Tax-free withdrawals**

- yes checkmark Investment portfolios

- no x Income restrictions

- no x Age restrictions for withdrawals

- no x Lower contribution limits

Bank Savings Account3

- no x No state tax deductions

- no x No tax-deferred growth

- no x No tax-free withdrawals

- no x No investment portfolios

- yes checkmark No income restrictions

- yes checkmark No age restrictions for withdrawals

- yes checkmark High annual contribution limits

Moreover, money saved in a 529 does not disqualify students for financial aid. 529 assets are typically treated as belonging to the parent (or grandparent, etc.) and count less in Expected Family Contribution (EFC) calculations than assets held in the child’s name.

Learn more at https://studentaid.gov/ or check with the schools you are considering.

Moreover, money saved in a 529 does not disqualify students for financial aid. 529 assets are typically treated as belonging to the parent (or grandparent, etc.) and count less in Expected Family Contribution (EFC) calculations than assets held in the child’s name.

Learn more at https://studentaid.gov/ or check with the schools you are considering.

Why choose Edvest 529

- Wisconsin taxpayers can qualify for a 2026 state tax deduction up to $5,280 for each contributor per beneficiary per year from contributions made into an Edvest 529 College Savings Plan. Contributions in excess of these amounts may be carried forward and applied in subsequent tax years, subject to annual limitations.4

- With an Edvest 529 account, any growth you see over time won’t be subject to taxes in the future if used for qualified higher college expenses.

- Edvest 529 savings do not disqualify students from financial aid. Assets in a 529 plan owned by a dependent student or the parent who files the FAFSA are considered parental assets. A maximum of 5.64% of parental assets are counted in determining the Student Aid Index (SAI).5

- Assets held in an Edvest 529 account owned by a grandparent or anyone outside of the custodial household are not considered at all in financial aid calculations.

Have any questions about ways to save for college? We have answers.

Edvest 529 provides a unique set of benefits that can mean more flexibility and growth potential, including:

- Tax-free qualified withdrawals

- Wisconsin state tax deduction

- Low fees and expenses

- Easy-to-choose investment portfolios

- Favorable financial aid treatment

- Use for a wide range of education expenses and programs—in Wisconsin and around the world

Get more details and compare savings options.

No. Your Edvest 529 funds can be used at any eligible higher education institution in the country—and even some abroad. This includes public and private colleges and universities, apprenticeships, community colleges, graduate schools and professional schools. Up to $20,000 annually can be used toward K-12 qualified expenses (per student). In addition, your 529 can be used for student loan repayment up a $20,000 lifetime limit per individual.1 Review a list of qualifying expenses and the state tax treatment of withdrawals for these expenses in the Plan Description.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

Edvest 529 account owners can benefit from three types of tax advantages:

- Wisconsin State Income Tax Deduction - Wisconsin taxpayers are eligible for a state income tax deduction on contributions to the Edvest 529 College Savings Plan.

- Tax-deferred growth - With an Edvest 529 account, if your money grows over time through investment earnings, unlike some other investment account, you will not be taxed on the growth (earning portions) while the funds are in the account.

- Tax-free withdrawals for qualified educational expenses - Unlike taxable investment accounts, if you use your funds to pay for qualified higher education expenses, then you do not have to pay state or federal taxes on the earnings at all.

Learn more about Edvest 529's tax benefits.

If you don't use your funds on qualified expenses – only the earnings portion withdrawn is subject to state and federal income tax, as well as a 10% federal tax penalty. The contribution portion of your account will never be taxed or penalized because it was made with after-tax dollars.

Additionally, there are instances in which the 10% tax penalty does not apply, such as the death or disability of the beneficiary and the receipt of a qualified scholarship by the beneficiary.

So remember - the unique tax advantages of saving with Edvest 529 include the Wisconsin state income tax deduction, tax-deferred growth, and tax-free withdrawals for qualified educational expenses.

Wisconsin taxpayers are eligible for a state income tax deduction for contributions to the Edvest 529 College Savings Plan. The maximum deduction on contributions made to an Edvest 529 account for the 2025 tax year is:

- $5,130 per Beneficiary for a single filer or married couple filing a joint return; or

- 2,560 per Beneficiary for a married couple filing separately.

The maximum deduction on contributions made to an Edvest 529 account for the 2026 tax year is:

- $5,280 per Beneficiary for a single filer or married couple filing a joint return; or

- $2,640 per Beneficiary for a married couple filing separately.

The Wisconsin state income tax deduction for contributions made to a Wisconsin 529 plan is available to any Wisconsin taxpayer, not just the 529 plan account owner, making gift contributions a benefit for family members or friends.

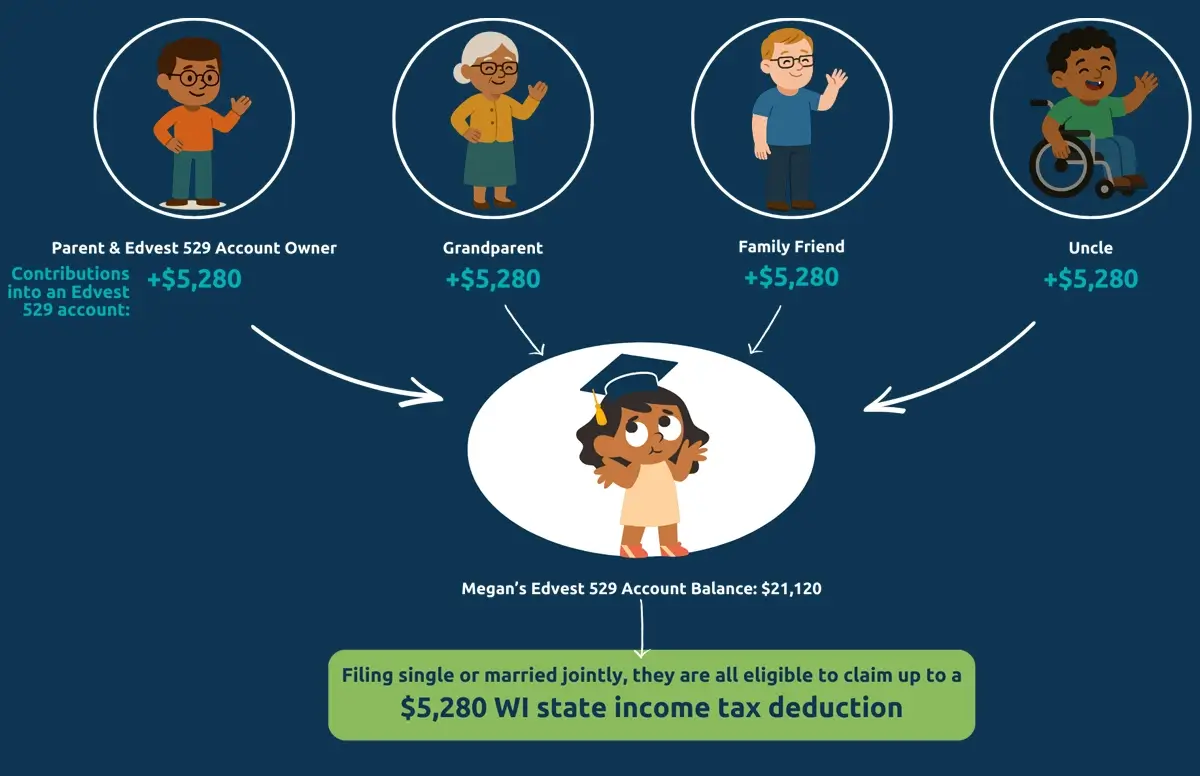

Example 1: Multiple Contributors

The Edvest Account Owner (Parent) contributes $5,280 to their child's (Megan's) account, a Grandparent also contributes $5,280 to Megan's account, a family friend also contributes $5,280 to Megan's account, and her uncle contributes $5,280 to Megan’s account during the 2026 tax year. The parent, grandparent, family-friend, and uncle, are all eligible to claim the $5,280 Wisconsin state tax deduction on their 2026 Wisconsin state incomes taxes (if their filing status is married filing joint or single).

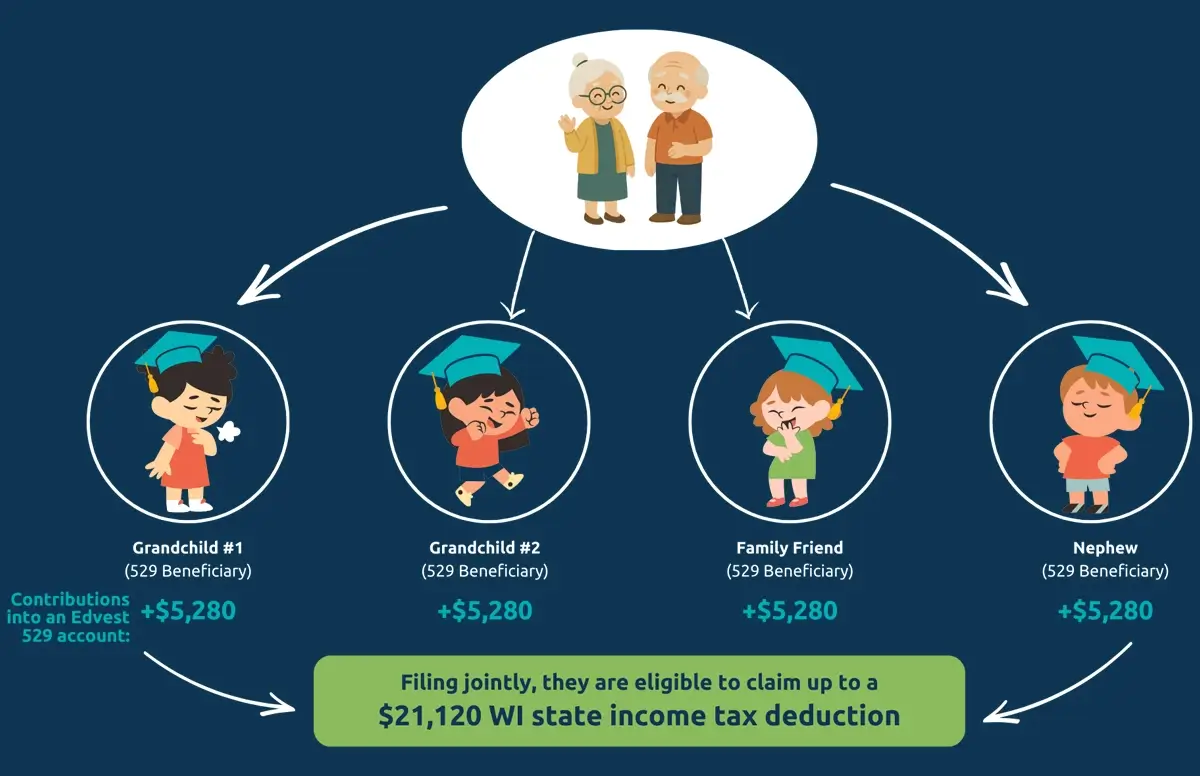

Example 2: Multiple Beneficiaries

Grandpa and Grandma Lee have Edvest 529 accounts for their 2 grandchildren, and contributed to a family-friend’s Edvest 529 account, and their nephew’s Edvest 529 account. They contributed $5,280 to each child's account ($21,120 total). When filing their Wisconsin state income taxes, as married filing jointly, they are eligible to claim a deduction of $21,120 from their income.

A Wisconsin taxpayer is permitted a deduction from Wisconsin adjusted gross income for a contribution to an account less any Qualified Withdrawals made during the tax year. Rollovers of the principal amount into an Edvest 529 account are eligible for the subtraction from state taxable income, subject to applicable yearly limitations. Amounts in excess of the current tax year's deduction limit may be carried forward to future years and claimed as a subtraction subject to the yearly limitations. Wisconsin taxpayers should be aware that the Wisconsin 529 College Savings Program requires the use of a "first in, first out" method of accounting. Any withdrawals taken from a 529 account within 365 days of being contributed, or carried forward, must be added back to the filer's taxable income for state tax purposes.