Expanded Qualifying Expenses Passed with New Bill

published August 11, 2025

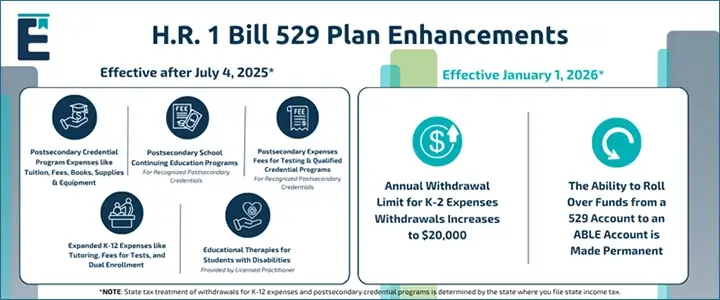

The signing of the 2025 U.S. Budget Reconciliation Bill (H.R. 1) into law on July 4, 2025, has made substantial changes to what are considered Qualified Higher Education Expenses for 529 college savings plans. The enhancements outlined below give Wisconsin taxpayers more flexibility and support to pay for a broader range of kindergarten through 12th grade (K-12) school expenses and allow for expenses related to career-focused postsecondary credential programs.

*NOTE: State tax treatment of withdrawals for K-12 expenses and postsecondary credential programs is determined by the state where you file state income tax.

Postsecondary Credential Program Expenses

Effective for withdrawals after July 4, 2025, students who enroll in a recognized postsecondary credential program can use their 529 funds to pay for:

- tuition, fees, books, supplies, and equipment required for the enrollment or attendance in a recognized postsecondary credential program.

- fees for testing if such testing is required to obtain or maintain a recognized postsecondary credential, and

- fees for continuing education if such education is required to maintain a recognized postsecondary credential.

Recognized Postsecondary Credential Programs

To determine if a Postsecondary Credential Program would qualify, please refer to the following language from the bill:

The term 'Recognized postsecondary credential program' means any program to obtain a recognized postsecondary credential if--

- such program is included on a State list prepared under section 122(d) of the Workforce Innovation and Opportunity Act (29 U.S.C. 3152(d)),

- such program is listed in the public directory of the Web Enabled Approval Management System (WEAMS) of the Veterans Benefits Administration, or successor directory such program,

- an examination (developed or administered by an organization widely recognized as providing reputable credentials in the occupation) is required to obtain or maintain such credential and such organization recognizes such program as providing training or education which prepares individuals to take such examination, or

- such program is identified by the Secretary, after consultation with the Secretary of Labor, as being a reputable program for obtaining a recognized postsecondary credential for purposes of this subparagraph.

Also,

- any postsecondary employment credential that is industry recognized and is--

- any postsecondary employment credential issued by a program that is accredited by the Institute for Credentialing Excellence, the National Commission on Certifying Agencies, or the American National Standards Institute,

- any postsecondary employment credential that is included in the Credentialing Opportunities On-Line (COOL) directory of credentialing programs (or successor directory) maintained by the Department of Defense or by any branch of the Armed Forces, or

- any postsecondary employment credential identified for purposes of this clause by the Secretary, after consultation with the Secretary of Labor, as being industry recognized,

- any certificate of completion of an apprenticeship that is registered and certified with the Secretary of Labor under the Act of August 16, 1937 (commonly known as the 'National Apprenticeship Act'; 50 Stat. 664, chapter 663; 29 U.S.C. 50 et seq.),

- any occupational or professional license issued or recognized by a State or the Federal Government (and any certification that satisfies a condition for obtaining such a license), and

- any recognized postsecondary credential as defined in section 3(52) of the Workforce Innovation and Opportunity Act (29 U.S.C. 3102(52)), provided through a program described in paragraph (2)(A).

Expanded Qualifying K-12 Expenses

Beginning with withdrawals made after July 4th, Wisconsin taxpayers may use their 529 savings for a wider range of K-12 educational expenses. In addition to K-12 tuition, the below expenses are now considered qualified expenses for K-12 students, and will not be subject to federal or Wisconsin state taxes when withdrawn:

- Tuition and curricular materials.

- Books or other instructional materials.

- Online educational materials.

- Tuition for tutoring or educational classes outside of the home, including at a tutoring facility, but only if the tutor or instructor is not related to the student and-- is licensed as a teacher in any state, has taught at an eligible educational institution, or is a subject matter expert in the relevant subject.

- Fees for a nationally standardized norm-referenced achievement test, an advanced placement examination, or any examinations related to college or university admission.

- Fees for dual enrollment in an institution of higher education.

- Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical, and speech-language therapies.

Effective January 1, 2026:

Starting January 1, 2026, the annual limit for K-12 school withdrawals will double from $10,000 per year/per beneficiary to $20,000, giving families more room to cover educational costs.

Additionally, the law made permanent the option for families to roll over funds from a 529 account into an ABLE account. An ABLE account is a savings and/or investment option for people with disabilities who qualify.

NOTE: State tax treatment of withdrawals for K-12 school expenses and postsecondary credential programs is determined by the state where you file state income tax. Please consult with a tax advisor before withdrawing funds for any such expenses.

Together, these changes represent a meaningful step forward in making 529 College Savings Plans more inclusive, adaptable, and supportive of a wide range of educational goals. Whether you're saving for K-12 school, specialized learning support, or post-secondary credentials, 529 plans can offer more ways to put your savings to work.

###

To learn more about Wisconsin's Edvest 529 College Savings Plan, its investment objectives, risks, charges and expenses see the Plan Description at Edvest.com before investing. Read it carefully. Investments in the plan are neither insured nor guaranteed and there is the risk of investment loss. Prior to investing, check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. If the funds aren't used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Consult your legal or tax professional for tax advice. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Edvest 529 College Savings Plan.

4685398

More to explore

-

Explore our plan

Learn more about eligibility and all the qualifying expenses an Edvest 529 account can cover.

How our 529 works -

Compare investment portfolios

We make it easy to choose investment portfolios that fit your financial needs and savings goals.

Discover your options -

Ready to get started?

Open an Account