Rolling Unused Edvest 529 Savings to a Roth IRA

published March 31, 2025

Families who are saving for future education costs in 529 plans may rollover unused funds from a 529 account into a Roth IRA (Individual Retirement Account) for the account beneficiary without incurring federal tax penalties. For Wisconsin taxpayers, a rollover from a 529 plan account to a Roth IRA is permitted without incurring federal or Wisconsin income tax or penalties. State tax treatment of a rollover from a 529 plan into a Roth IRA is determined by the state where you file state income tax.

The following rules apply to 529 plan rollovers to Roth IRAs:

- The 529 plan account must be open for 15 or more years, ending with the date of the rollover (15-year rule);

- Contributions and associated earnings that you transfer to the Roth IRA must be in the 529 plan account for more than five (5) years, ending with the date of the rollover (5-year rule);

- The Internal Revenue Code permits a lifetime maximum amount of $35,000 per designated beneficiary to be rolled over from 529 plan accounts to Roth IRAs;

- The Roth IRA contribution is subject to the Roth IRA contribution limit for the taxable year applicable to the designated beneficiary for all individual retirement plans maintained for the benefit of the designated beneficiary;

- 529 plan assets can only be rolled over into a Roth IRA maintained for the benefit of the designated beneficiary on the 529 plan account;

- 529 plan assets must be sent directly to the Roth IRA (trustee-to-trustee); and

- Roth IRA income limitations are waived for 529 plan rollovers to Roth IRAs.

Please be aware that the IRS may issue additional guidance that could impact 529 plan account rollovers to Roth IRAs, including the above-referenced conditions. Account Owners and Beneficiaries should consult a qualified tax professional before withdrawing funds for any such rollovers. Contact your Roth IRA administrator directly to determine their ability and requirements to receive a 529 rollover.

Edvest 529 account owners can request a full or partial rollover from their Edvest 529 account to the beneficiaries existing Roth IRA account by completing the Edvest 529 Direct Rollover Out to Roth IRA Form. We recommend reviewing the FAQs below for more information on this new process.

-

Q: How do I rollover money from my Edvest 529 account to a Roth IRA?

A: Please follow the steps below. We also recommend consulting a qualified tax professional before executing a rollover.

- Contact your Roth IRA administrator first to determine their ability and requirements to receive the rollover from a 529 plan. (Some Roth IRA administrators are not ready to accept this type of rollover).

- Complete any required Roth IRA rollover form available from your Roth IRA administrator and submit as instructed.

- Complete the Edvest 529 Direct Rollover Out to Roth IRA Form, or call Edvest 529 at 1-888-338-3789 to ask that a form be mailed to you, and submit as instructed.

-

Q: How can I find my account creation date?

A: Account owners should contact Edvest 529 directly at 1-888-338-3789 to find their account creation date. If the account was rolled over to Edvest 529 from another state’s 529 plan, the Edvest call center can provide the date the account was opened with Edvest 529, but the account owner must consult their own records or contact the original 529 plan for the initial account creation date.

-

Q: Can I make the request to rollover money in my Edvest 529 plan to a Roth IRA online through my account portal?

A: No. All Roth IRA rollover requests will be processed manually using the Direct Rollover Out to Roth IRA Form.

-

Q: Can an account owner take a withdrawal from their Edvest 529 account and then send the money to a Roth IRA account (are indirect rollovers allowed)?

A: No. A rollover from an Edvest 529 account to a Roth IRA account must be trustee-to-trustee, meaning funds must go directly from Edvest 529 to the Roth IRA trustee. Contact your Roth IRA administrator directly to determine their ability and requirements to receive a 529 rollover before initiating a rollover.

The Roth IRA account must be opened before requesting a rollover. If the Roth IRA trustee requires a Letter of Acceptance, the account owner will need to direct them to send that letter to Edvest 529 before Edvest 529 can rollover the funds. Funds can only be sent to the trustee.

-

Q: Does my beneficiary have to be over the age of 15 to qualify for a rollover to a Roth IRA?

A: There is no age requirement of the beneficiary, but it is required that the beneficiary of the 529 account be the same as the owner of the Roth IRA account.

-

Q: Section 529 requires that the 529 account be open for at least 15 years before a qualified rollover may be made to a Roth IRA. If my Edvest 529 account was opened with a rollover from another plan, does that reset my 15-year clock?

A: Currently, Edvest 529 does not have any guidance from the IRS on whether a rollover from another 529 plan resets the 15-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide such guidance.

-

Q: If I change my beneficiary, does that reset my 15-year clock?

A: Currently, Edvest 529 does not have any guidance from the IRS on whether a change of beneficiary resets the 15-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide such guidance.

-

Q: If I change the account owner, does that reset my 15-year clock?

A: Currently, Edvest 529 does not have any guidance from the IRS on whether a change of account owner resets the 15-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide such guidance.

-

Q: How do I know which funds have been invested for at least 5 years and are eligible to rollover?

A: Currently, Edvest 529 does not have any guidance from the IRS on this five-year requirement. The 529 industry submitted a letter to the IRS in September 2023 seeking guidance on this issue. It is unclear if or when the IRS will provide such guidance.

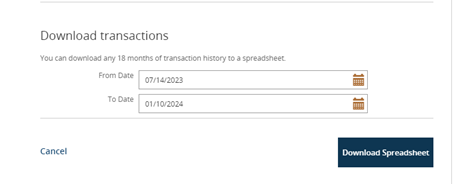

Account owners can review transactions and sort by year online through their Edvest 529 account access. Once an Account Owner logs into their account, click “Transactions”, and then “Download”. The transaction items can be exported and sorted by year to research contributions further.

-

Q: How do internal transfers between Edvest 529 accounts impact rollover eligibility?

A: Currently, Edvest 529 does not have any guidance from the IRS on how funds transferred from one Edvest 529 account to another Edvest 529 account impact the ability to rollover to a Roth IRA. It is unclear if or when the IRS will provide such guidance on whether the transferred funds are viewed as “new funds” in the receiving account and, therefore, not eligible for rollover as it relates to the 5-year rule. To the extent that this references a beneficiary change, please see FAQ #7 above.

-

Q: If my account has closed, and I request to reopen my account, does that reset my 15-year clock?

A: The IRS has not provided guidance on how it would handle this situation. If the IRS were to treat such an account re-opening as not resetting the 15-year clock, any new contributions would have to be in the account for at least 5 years.

###

To learn more about Wisconsin's Edvest 529 College Savings Plan, its investment objectives, risks, charges and expenses see the Plan Description at Edvest.com before investing. Read it carefully. Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss. Prior to investing, check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. If the funds aren't used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Consult your legal or tax professional for tax advice. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Edvest 529 College Savings Plan.

Funds rolled over to a Roth IRA can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction and state income tax. Account Owners and Beneficiaries should consult with a qualified tax professional before rolling over funds from their 529 plan to contribute to a Roth IRA.

4341421

More to explore

-

Explore our plan

Learn more about eligibility and all the qualifying expenses an Edvest 529 account can cover.

How our 529 works -

Compare investment portfolios

We make it easy to choose investment portfolios that fit your financial needs and savings goals.

Discover your options -

Ready to get started?

Open an Account