Everything You Need to Know About Withdrawing 529 Funds for Back to School

published August 1, 2024

It’s that time of year when kids of all ages prepare to return to school. And for many families, it’s your “big” kid’s turn to start their post-secondary education journey.

You’ve been saving up for a while with your Edvest 529 account, and now you need to start using those funds for your student’s tuition, books, supplies, room and board, and other qualified higher education expenses.

In this article, we will go through everything you need to know about withdrawing 529 funds, including:

The process for withdrawing 529 funds is simple, and Edvest 529 is here to support you with any assistance you may need.

What are Qualified, Taxable, and Non-Qualified Withdrawals?

Withdrawals from your Edvest 529 account can fall into three categories: qualified, taxable, and non-qualified. You’ve likely heard a lot about qualified withdrawals because they can be withdrawn without federal or state income tax or penalties.

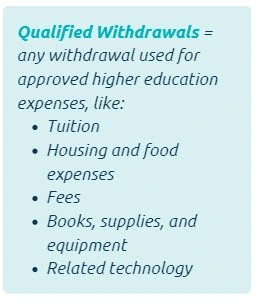

What is a Qualified Withdrawal?

A qualified withdrawal is any withdrawal used for approved higher education expenses. Using your Edvest 529 funds for these costs are free from federal and Wisconsin income taxes.

These include:

- Tuition at any eligible college or university in the country (and many schools abroad).

- Housing and food expenses.*

- Fees.

- Books, supplies, and equipment (such as a computer).

- Related technology, including internet access fees, software, or printers.

Qualified withdrawals must be taken within the same year expenses were incurred or you may be subject to taxes and penalties.

Qualified Withdrawals Footnote

- *The beneficiary must be enrolled at least half-time at an eligible postsecondary institution. For students living in housing owned and operated by the institution, the full invoice amount will be used to determine the qualified housing and food expenses. In the case of students living at home or in off-campus housing, the “cost of attendance” allowance for the individual institution will be used for the qualified housing and food expenses.↩

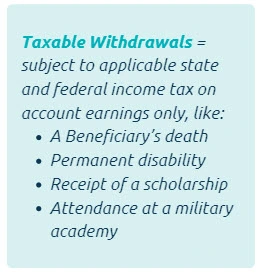

What is a Taxable Withdrawal?

A taxable withdrawal will be subject to applicable state and federal income tax on account earnings only, not on the principal portion (the portion you contributed). However, it will not be subject to a 10% additional federal tax on earnings (the “Additional Tax”).

Some examples of taxable withdrawals include: withdrawing funds due to a beneficiary’s death, permanent disability, receipt of a scholarship award, or attendance at a U.S. military academy.

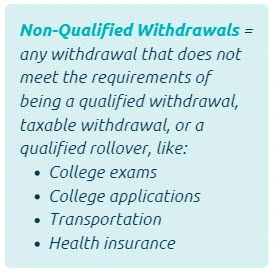

What is a Non-Qualified Withdrawal?

A non-qualified withdrawal is any withdrawal that does not meet the requirements of being a qualified withdrawal, taxable withdrawal, or a qualified rollover to another 529 college savings plan, Achieving a Better Life Experience (ABLE) account, or a Roth IRA for the Beneficiary (subject to criteria and limitations).1 If you use 529 funds for non-qualified expenses, your account earnings are subject to state and federal income taxation and a 10% additional federal penalty tax on account earnings (the “Additional Tax”). Account earnings are the portion of your funds that have grown over time, and do not include your principal (the portion you have contributed).

According to Saving For College, non-qualified expenses could include college examinations, applications, testing fees, and/or ACT/SAT prep. Expenses that aren’t directly associated with attending school, like transportation, health insurance, or miscellaneous living expenses, are also not considered qualified expenses.2

How Do I Withdraw My 529 Funds?

With Edvest 529, you can make a withdrawal online or by mail. Most withdrawals are performed electronically, making it quick and easy to get your funds.

If you haven’t already linked a bank account to receive funds, you will need to update your account information with the following details, for either yourself or the beneficiary:

- Bank account number

- Bank routing number

- Account type: Checking or Savings

- Name as it appears on the account

Note: You will not be able to withdraw a contribution until eight business days after it has been received by Edvest 529.

Let’s look at the steps you’ll need to take to withdraw 529 funds online.

How to Withdraw 529 Funds Online

- Log in to your Edvest 529 account online. Once logged in, click on the “Withdraw” link on the right side of the account home page.

- Select the type of withdrawal:

- Qualified withdrawal

- Qualified withdrawal for K-12 tuition expenses

- Withdrawal for student loan expenses

- Withdrawal for apprenticeship expenses

- Non-qualified withdrawal

- Select where the funds will be sent:

- Directly to the college or school – Select the state where the school is located and the school’s name, and if the funds should be sent via electronic payment or by check.

- If you do not see your school listed, select “My school is not listed” (the last option in the drop-down menu) to either send a check to the school or transfer funds to the Account Owner or Beneficiary bank account. Each individual school must choose whether to accept electronic payments from Edvest 529.

- If electronic payment: Verify or enter the mobile phone number to receive text updates or opt-out of receiving text updates.

- If by check: Select the delivery speed, enter the college name and address, and include the student ID in the ‘check memo’ field.

- Account Owner – Select bank account and certify, or if by check, select the delivery speed and complete the check memo.

- Beneficiary – Select bank account and certify, or if by check, select the delivery speed and complete the check memo.

- For funds sent to the Owner or Beneficiary, select “Partial” or “Total” account balance withdrawal.

- Directly to the college or school – Select the state where the school is located and the school’s name, and if the funds should be sent via electronic payment or by check.

- If you have multiple investment portfolios, select “Prorated Amount” or “By Specific Portfolio.”

- Enter the withdrawal amount(s).

- For funds sent directly to the college or school, enter the school’s required information and the Student ID of the beneficiary.

- Verify that the withdrawal information is correct (type, delivery method, investment portfolios, and amount).

- Select “Submit,” and you’re done!

Note: If funds are sent to the Beneficiary or directly to a school, the Beneficiary will receive a 1099-Q. If funds are sent to the Account Owner, the Account Owner will receive a 1099-Q.

Want more information? Check out our “Step-by-step guide on Withdrawing from Your 529 Account Online” video:

How to Withdraw 529 Funds by Mail

If you prefer to handle your withdrawal via mail, you must download or request the Edvest 529 Withdrawal Request Form by calling 1-888-338-3789. Find step-by-step instructions on how to withdraw by mail at www.edvest.com/account/faq.

Frequently Asked Questions about Withdrawing Edvest 529 Funds

The Edvest 529 Plan Description provides many answers and details about your account and withdrawals. But in the meantime, we have some helpful FAQs about withdrawing your Edvest 529 funds.

- How quickly can you receive a withdrawal from an Edvest 529 account?

Typically, the process takes 3-5 days, and you will receive a check. - Do Edvest 529 qualified withdrawals need to be made in the same year expenses were incurred?

Yes. All 529 plan withdrawals must be taken in the same year the qualified expenses have been incurred. If not, the withdrawal may be taxable, and you could experience a tax penalty. - Can you reimburse yourself from an Edvest 529 account?

You can reimburse yourself for qualified expenses from your 529 plan after you’ve already paid for them, as long as you withdraw the funds in the same calendar year. If you reimburse yourself for non-qualified expenses, you will be subject to tax on that withdrawal. - How do scholarships impact Edvest 529 plan withdrawals?

If the beneficiary receives a scholarship that covers the cost of qualified expenses, you can withdraw the funds from your account up to the amount of the scholarship without incurring the 10% federal tax penalty on the earnings portion. However, the earnings portion will be subject to federal and state income tax. If the amount withdrawn exceeds the amount of the scholarship, the earnings portion of the excessive portion withdrawn will be subject to the additional 10% federal penalty tax. Please consult with a qualified tax professional. - How much can I withdraw from my Edvest 529 plan each year for qualified expenses?

If your child is enrolled in post-secondary education, there is no limit on the amount you can withdraw from your 529 plan. Wisconsin taxpayers may withdraw up to $10,000 tax-free annually (per beneficiary) to pay for K-12 tuition attendance at a primary or secondary public, private or religious school. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. - Will I get a tax form after I make a withdrawal?

Edvest will issue a 1099-Q for all withdrawals made in the calendar year. The 1099-Q will be issued to the account owner if the withdrawal is directed to you (mailed check or ACH). The 1099-Q will be issued to the beneficiary if the withdrawal is made to them, or to the educational institution.

Get Ready for Back to School

Now that you know everything about withdrawing your Edvest 529 funds, it’s time to get your student ready to go back to school. Whatever you do, you can rest assured that your student will be ready and have everything they need with the savings you built from your 529 account.

###

To learn more about Wisconsin's Edvest 529 College Savings Plan, its investment objectives, risks, charges and expenses see the Plan Description at Edvest.com. Read it carefully. Investments in the plan are neither insured nor guaranteed and there is the risk of investment loss. Wisconsin taxpayers can qualify for a 2024 state tax deduction up to $5,000 annually per beneficiary, for single filer or married couple filing a joint return, from contributions made into an Edvest 529 College Savings Plan. Married couples filing separately may each claim a maximum of $2,500. Prior to investing, check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. Consult your legal or tax professional for tax advice. If the funds aren't used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Consult your legal or tax professional for tax advice. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for the Edvest 529 College Savings Plan.

Footnotes

- 1Funds rolled over to a Roth IRA can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction and state income tax. Account Owners and Beneficiaries should consult with a qualified tax professional before rolling over funds from their 529 plan to contribute to a Roth IRA.↩

- 2Source: Saving for College, “How to Withdraw Money from Your 529 Plan,” 2024↩

FGN-3687035CR-Y0824W

More to explore

-

Explore our plan

Learn more about eligibility and all the qualifying expenses an Edvest 529 account can cover.

How our 529 works -

Compare investment portfolios

We make it easy to choose investment portfolios that fit your financial needs and savings goals.

Discover your options -

Ready to get started?

Open an Account